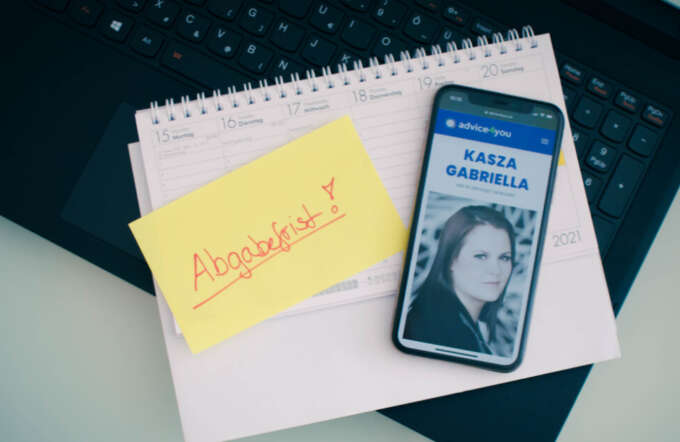

Tax advisor, payroll accountant, chartered accountant, social security and pension expert, etc… I have earned all of these qualifications in the past years in Hungary and in Austria.I provide a personalized blend of these to my clients, who wish to have all of their tax and financial affairs in one hand.

I have been living in Austria since 2010, so I mainly know the Austrian market. I can help the most if there is an Austrian or Hungarian aspect to the case.

The main focus of my consulting activity is complex international tax and social security matters for both individuals and corporate clients. In addition, I am happy to help you prepare an Austrian employee tax refund, whether you are an assignee, a commuter or moving to Austria. I can also provide start-up advice and income-expenditure calculations for small entrepreneurs.

Togheter with my partners (o4u GmbH, FAS Network GmbH and GOBBS Steuer- und Unternehmensberatungs-GmbH) we provide complete services in the area of tax consulting, accounting and payroll for our clients.

Professional experience

I began my career at PricewaterhouseCoopers during college in 2006 and then continued at Deloitte in 2007. Due to an assignment within the company, I moved to Austria. After several years of tax advisory with Deloitte, I moved on to Waagner-Biro, where I managed the tax- and social security issues of the assignees as a part time employee at first, and afterwards as an external advisor. I have been self-employed since 2014 (tax advisor for FAS Network and GOBBS). In 2018 I founded my own company – advice4you e.U.. In 2022 I founded the o4u GmbH, where I provided office adminstration services to my clients, as of the end of 2023 charterd accountat services will be also provided to my clients by the o4u and its employees. Since then I have been approached by several consulting firms, tax advisors and HR departments to be an external advisor for their tax-, social security and payroll issues.

Qualifications

economist diplom with bachelor degree, majoring in Finance, specialising in Taxes and Duties - Budapest Business School

chartered accountant

tax advisor exam

registered tax advisor

Diplom employment and social security rights

financial advisor exam

Certificate to train apprentices

pension expert

certified insurance advisor BÖV

payroll accountant

chartered accountant

tax advisor exam

I regularly attend trainings for taxation law, especially for assignments, international taxation and social security law.

The topics close to my heart are still the tailored solutions for complex international tax/social security issues.

CUSTOMERS

Individuals who are not yet familiar with Austrian facilities, or may not speak German (well enough) to make financial decisions.

My main focus is therefore the consultancy and preparation of Austrian tax returns, correspondence with the tax office, clarification of international social security questions (pension, health insurance), administration, obtaining EU forms (E104, S1/E106, etc) and clarification of international tax questions.

For tax advisers, accountants and payroll accountants I undertake professional reviews of international personal income tax and social security issues, after which we will discuss my suggestions for further proceedings. Furthermore, I can assist with questions about the international payroll of assignees, or if help is needed in the setting up of the processes.

Global Mobility Services – for HR departments, multinational companies: I undertake the review of international assignees and related contracts, the clarification of tax and social security aspects, the establishment of tasks, the review, development or optimization of the company’s assignment policy.

SERVICES

ONLINE SHOP

FIRST CONSULTING HOUR

- The first consultant hour lasts a maximum of 60 minutes. Any additional time will be billed at the actual hourly rate.

- The price is net (+ 20% VAT)

- Validity: 1 year from purchase

PRICE INFORMATION

- Please read the information about my prices

- Updated information

ONLINE SEMINAR IN 3 LANGUAGES

- Online seminar about founding an (individual) company in Austria in Hungarian, German or English

- About 2-3 hours per seminar

- Sign up now

FIRST CONSULTING HOUR

- The first consultant hour lasts a maximum of 60 minutes. Any additional time will be billed at the actual hourly rate.

- The price is net (+ 20% VAT)

- Validity: 1 year from purchase

PRICE INFORMATION

- Please read the information about my prices

- Updated information

- As of 1st of July 2023

ONLINE SEMINAR IN 3 LANGUAGES

- Online seminar about founding an (individual) company in Austria in Hungarian, German or English

- About 2-3 hours per seminar

- Sign up now